- Call for a

Confidential Consultation - 954-587-2244

- Email Us

-

Originally published: November 2025 | Reviewed by Scott A. Levine

When child support payments get spotty or just stop, Florida courts have a powerful way to make sure kids still get the support they need.

Income Deduction Orders pull child support payments straight from a parent’s paycheck, so dodging payments really isn’t an option anymore.

This legal tool shields families from the rollercoaster of missed payments. It also makes the whole collection process smoother and less stressful.

Plenty of parents dealing with unpaid support don’t realize just how effective these orders can be.

The Florida Child Support Program sends income withholding notices to employers as soon as it knows where the paying parent works.

This takes the pressure off custodial parents, who’d otherwise have to chase down payments every month. That’s a huge relief, honestly.

Getting a handle on how Income Deduction Orders work helps both paying and receiving parents navigate the child support system with less confusion.

A Florida Income Deduction Order is a court order that requires a parent’s employer to deduct child support from the parent’s paycheck.

The court puts this in place to ensure support payments are made on time, without parents having to remember or argue about them.

Florida Statute §61.1301 lays out the rules for Income Deduction Orders in child support cases. This law tells employers to withhold support payments from an employee’s wages whenever there’s a valid IDO.

Key Legal Requirements:

IDOs get priority over most other wage garnishments. Employers must start making deductions in the first pay period after receiving the order.

Florida law protects employees from getting fired over these orders. If employers ignore an IDO, they could face penalties and have to pay what’s owed.

Income Deduction Orders aren’t the same as other child support enforcement methods in Florida. Other tools need someone to take action every time, but IDOs work automatically once they’re set up.

IDO vs. Other Enforcement Tools:

| Method | Timing | Court Action Required | Employer Involvement |

| Income Deduction Order | Automatic/ongoing | Initial order only | Yes – mandatory |

| Asset Seizure | After default | Yes – each time | No |

| License Suspension | After default | Yes – each time | No |

| Contempt of Court | After default | Yes – each time | No |

Enforcement methods like asset seizure or license suspension only come into play after payments are missed. IDOs jump in before things go off the rails.

Bank account levies and property liens need a new court process for each action. Once an IDO is in place, it just keeps running without extra legal steps.

Income Deduction Orders offer real benefits for both the paying parent (obligor) and the receiving parent (obligee). The automatic setup means fewer arguments and more predictable support.

Benefits for Paying Parents:

Benefits for Receiving Parents:

Kids are the real winners here—they get steady financial support. That stability helps keep their lives on track and their needs met.

IDOs also lighten the load on Florida’s child support system. With collections running on autopilot, the state can focus on the tough cases that need more attention.

Florida courts issue Income Deduction Orders through set procedures, with all the paperwork and notifications in place.

These orders usually kick in right away, but sometimes only after payments fall behind—it really depends on the case.

Florida law says IDOs have to include certain details to be valid. The order needs the obligor’s full name and Social Security number, plus the obligee’s name and address for where payments go.

Required Payment Information:

The order specifies the exact dollar amount or percentage to deduct from each paycheck. Usually, courts won’t allow withholding to exceed 50% of the obligor’s take-home pay for current support.

Employers get clear instructions on how to determine the correct amount and where to send it. The order also lists any fees employers can deduct for handling the payments.

Florida requires IDOs to be served properly so everything is legal and enforceable. The Department of Revenue or the court clerk sends the order to employers by certified mail, return receipt requested.

If you’re in Broward, confirm your mailing address and email with the Broward Clerk of Courts to avoid returned notices or default settings.

Service Requirements Include:

Employers receive a separate notice that breaks down their legal responsibilities. This explains the most they can withhold under state and federal law, and what penalties they might face for not following the order.

The parent who has to pay (the obligor) also receives a notice that an IDO is in place. This notice tells them they can request a hearing to challenge the withholding and sets a deadline for doing so.

The Broward Clerk of Courts mails official delinquency and hearing notices to the obligor’s last known address. Keeping your contact information current avoids missed deadlines or default orders.

Florida courts can make an IDO start right away or only after the parent falls behind. These days, immediate withholding is the default for most new child support cases.

Immediate IDOs start as soon as the employer gets the order. The employer has to begin withholding in the first pay period that occurs 14 days after they receive it, regardless of whether the parent is up to date.

Upon Delinquency, IDOs only kick in if payments fall behind. In that case, the court or child support enforcement agency tells the employer when to start. These are rare, but sometimes the court goes this route.

The order’s effective date tells employers when to start deducting money. Florida law limits how much can be withheld from each paycheck, and employers can’t fire someone just because of an income withholding order.

If you’re ready to get started, call us now!

Income withholding means that child support is deducted from a parent’s paycheck before they see it. Federal law sets the limit on how much can be taken, and employers have to follow specific rules for collecting and sending the money.

Employers must begin withholding child support within 14 days of receiving an Income Deduction Order. There’s no wiggle room on this deadline.

They have to take out the set amount from each paycheck, every time. Skipping payments or rolling several together isn’t allowed.

Employers must:

Timeline: Florida employers start within 14 days of receiving the order and remit within seven business days after each payday to the State Disbursement Unit.

Employers must also report new hires to the state within 20 days. That helps Florida child support enforcement track down parents who owe support.

Employers have 14 days to start withholding and seven business days to forward payments to the Florida State Disbursement Unit.

They can’t charge the employee any fees for handling the deductions. All those costs stay with the employer.

The Consumer Credit Protection Act (CCPA) sets the maximum that can be withheld for child support. These limits make sure employees aren’t left without enough to live on.

Current support plus arrears:

Arrears only (past-due support):

Disposable income means what’s left after mandatory deductions like taxes and Social Security. Voluntary deductions, such as health insurance, still count as income for these calculations.

States can set lower caps, but they can’t go over the federal limits. Florida sticks to the federal CCPA rules for all income withholding orders.

Income withholding covers almost every type of compensation an employee gets. Regular wages are the most obvious, but the law extends far beyond just a paycheck.

Wages and salaries include:

Additional income sources subject to withholding:

Independent contractor payments may also be subject to withholding. It really depends on how the payor and recipient work together.

Some income types come with unique rules. Social Security benefits can get garnished for child support, but SSI? That’s off-limits.

Military pay usually follows the same rules as civilian jobs. Still, active-duty service members have extra protections under the Servicemembers Civil Relief Act.

Most compensation counts: wages, bonuses, commissions, pensions, unemployment, workers’ comp. SSI is exempt; Social Security benefits can be garnished.

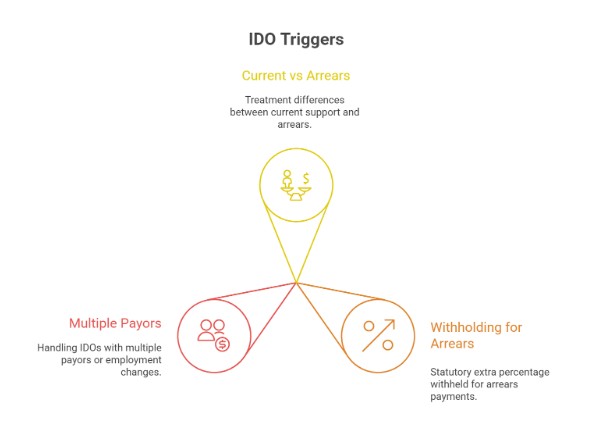

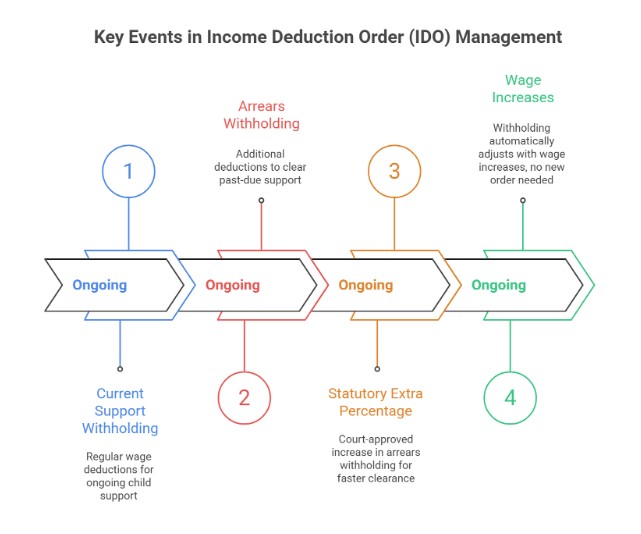

Income Deduction Orders (IDOs) automatically apply to current support payments. For arrears, they trigger once balances cross certain thresholds.

Florida courts use different withholding percentages for ongoing support versus past-due amounts.

Current support withholding starts as soon as a court enters a child support order. Florida law demands automatic income deduction unless both parents agree in writing to something else.

The deduction usually begins with the first paycheck after the employer gets the IDO. Employers have 14 days from the date they receive the order to start withholding.

Arrears treatment is a bit different. Past-due amounts accrue interest at 12% per year from the day each payment becomes overdue.

Courts can collect arrears in a few ways:

The state keeps detailed records of unpaid amounts. These balances keep growing until the parent pays in full or gets a modification.

Florida lets the state withhold up to 50% of disposable income if the parent has no other dependents. If there are other kids to support, the limit drops to 40% of disposable income.

Standard arrears withholding usually adds 20% to the current support amount. So if a parent owes $400 a month, the total withheld might be $480 ($400 plus $80 for arrears).

Florida allows courts to add up to 20% on top of current support until arrears are fully cleared.

Courts can go above these percentages in certain cases:

| Situation | Maximum Withholding |

| No other dependents | 50% disposable income |

| Supporting other children | 40% disposable income |

| Voluntary agreement | Up to federal limits |

Disposable income means what’s left after federal and state taxes, Social Security, and other mandatory deductions. Courts figure out this number before setting the withholding percentage.

Some parents actually agree to higher withholding so they can clear arrears faster. These deals need court approval before they kick in.

Multiple employers can make withholding messy. Florida’s child support enforcement systems track income from all sources to ensure that payments are not collected in excess.

The state usually grabs the primary employer first. If that’s not enough, secondary income sources get tapped.

Job changes mean the IDO needs to move to the new employer right away. Parents must report new jobs within 20 days or face contempt charges.

The process looks like this:

Self-employed parents get treated differently. Courts might order them to pay quarterly straight to the state instead of using payroll deductions.

Income verification often happens through employer reports. When wages go up, withholding goes up too—no need for a new court order every time.

Contesting an income deduction order takes valid legal grounds and strict attention to deadlines.

Parents can challenge orders for factual errors, identity mix-ups, or wrong amounts. Modifications, on the other hand, deal with changed circumstances.

Florida law allows parents to contest income deduction orders if certain mistakes occur. The big three are mistakes of fact, identity confusion, and incorrect payment amounts.

Contest windows are short: file within 15 days, or you’ll likely need a court modification.

Mistake of fact means the order got something wrong about the job, income, or payment history. This could be bad math on arrearages or using the wrong interest rate.

Identity mistakes occur when the wrong person receives a withholding order. Sometimes employers mix up employees with similar names or Social Security numbers.

Amount errors are just what they sound like—wrong calculations for support, arrearages, or fees. Maybe the order lists the wrong monthly payment or skips over past payments already made.

To contest, parents need to show their paperwork: pay stubs, bank statements, court orders, or proof of employment, all of which help.

The parent contesting the order has to prove the mistake. It’s up to them to show clear evidence that affects the withholding.

In Florida, parents have 15 days from the date they receive the notice to contest an income deduction order. The clock starts when the parent receives the notice, not when the employer does.

Miss the deadline, and the order becomes final and enforceable. After that, parents lose their right to contest through the administrative process.

Late contests have a high bar:

Courts rarely accept late contests unless the parent truly never got proper notice. Maybe a medical emergency or military deployment could count as good cause.

Once the 15 days are up, parents must go to court to seek a modification. That takes more time and money than the administrative route.

If you get a withholding notice, don’t wait. Even if you want to hire a lawyer, file a basic contest to protect your rights.

Modification just changes the withholding amount—it doesn’t stop it. Termination shuts down the order completely.

Modification happens when support changes because of:

Parents have to ask the court that issued the original order for a modification. The deduction updates automatically to match the new support amount.

Termination happens when:

Employers need written notice before they stop withholding. They can’t just take someone’s word for it or assume things have changed.

The Florida child support enforcement system keeps withholding until it gets a proper termination notice. If withholding stops by mistake, parents are still on the hook for payments.

If arrearages still exist, courts might deny termination. Current support might end, but withholding continues for unpaid amounts until they’re gone.

Facing wage withholding or arrears? Levine Family Law can explain Florida income deduction orders, file enforcement actions, and defend your rights. Call now for immediate guidance.

If you’re ready to get started, call us now!

Florida’s income deduction system runs into trouble when payors lack regular employers or are paid irregularly.

Courts have to use other tools for self-employed folks, juggle multiple support orders, and make sure bonuses or contract work count toward child support obligations.

Self-employed payors are tricky because there’s no employer to automatically garnish wages. The state can’t just send an income deduction order to a payroll department.

Florida courts usually order self-employed people to pay the State Disbursement Unit directly. They might set up quarterly or monthly payments based on projected annual income.

Other Enforcement Methods:

Self-employed folks have to bring detailed financial records to review hearings. Think profit and loss statements, tax returns, and business bank statements.

If payment history is spotty, the court might even ask for a bond or security deposit. That way, there’s a cushion if payments stop later.

If a payor has more than one child support order, Florida uses allocation rules to fairly divide available income.

Priority Order:

The Consumer Credit Protection Act caps total garnishment at 50-60% of disposable income, depending on the situation. Courts split this amount between the different orders.

Say a payor owes $800 a month across two orders ($500 and $300). Each order gets a proportional share of whatever gets garnished.

Allocation Calculation:

Florida law says income deduction orders must cover all income sources, including bonuses, commissions, and contract pay. Employers need to withhold support from these payments, too.

Covered Income Types:

The withholding percentage stays the same across all income types. If regular wages get hit with 25% withholding, so does a bonus.

Employers must process bonus withholdings immediately. They can’t wait until the next regular paycheck to take out support.

Contract workers who get 1099 income might get direct court orders to pay. In those cases, the person has to figure out and submit the correct support percentage for each contract payment.

Both recipients and payors can protect their interests by staying organized and proactive.

Regularly monitoring payments and reaching out to employers quickly helps, and sometimes, knowing when to get legal help just makes life easier for everyone involved.

Smoother child support enforcement often comes down to just staying on top of these basics.

Recipients should keep detailed payment records to avoid headaches later. You should set up a simple monthly tracker with payment dates, amounts, and payment methods.

Check your bank statements often. Compare those deposits to the court-ordered amounts to spot any issues early.

Contact the State Disbursement Unit if payments are late or incorrect. Florida’s automated system usually works, but hey, glitches happen.

Make sure income deduction orders actually get to the payor’s employer. If you don’t see withholding within two pay periods, just call the payroll department and ask what’s up.

Update your contact info right away if you move or switch banks. If the state can’t find you, they can’t send your money, and that’s just frustrating for everyone.

Hang on to copies of every letter or email with child support enforcement. When you call, jot down the date, time, and who you spoke with. It sounds tedious, but you’ll thank yourself later if something gets messy.

Request payment history reports from Florida’s child support system every few months. These reports make tax time less painful and help you spot any weird patterns.

Payors need to let child support enforcement know within 10 days of changing jobs. If you don’t, you could face contempt charges or additional penalties —who wants that?

Give the new employer’s name, address, and payroll contact info. The sooner you do this, the faster they’ll start deducting from your paycheck at the new place.

Report address changes right away, or you might miss court notices. Florida’s pretty strict about keeping your contact info up to date.

Keep an eye on your pay stubs to make sure deductions match the court order. If something looks off—like too much coming out or nothing at all—reach out to payroll.

Document significant income changes like raises, demotions, or cut hours. If your income shifts by 15% or more for three months, it’s probably time to file a modification request.

Keep records if you’re unemployed. Apply for benefits fast and let child support enforcement know about the job loss, so you don’t rack up a ton of arrears.

Maintain health insurance for your kids if you’re supposed to. Tell the other parent and the agency if you change coverage or the premiums adjust—it just keeps things simpler for everyone.

Attorneys really step in when standard enforcement tools just don’t work. If you’re dealing with complex financial situations that call for forensic accounting or business valuations, you’ll want legal expertise on your side.

When payors try to hide assets or income, legal representation matters; attorneys can subpoena bank records, business documents, and tax returns—things you probably can’t get on your own.

Got an interstate case? You’ll need someone who actually knows the ins and outs of different state laws. Attorneys who work with the Uniform Interstate Family Support Act can handle those tricky jurisdictional issues.

If you’re facing contempt proceedings for non-payment, court representation is almost always necessary. Attorneys can present evidence of willful noncompliance and seek appropriate sanctions.

When it comes to modification requests—such as significant changes in income or custody—legal guidance is invaluable. Attorneys, keep your paperwork in order and follow the proper steps.

Business owners and self-employed payors bring a whole different set of headaches. Legal counsel can investigate income manipulation and seek honest financial disclosure through discovery.

Levine Family Law helps Broward parents enforce child support through income deduction orders and court motions. Protect your child’s stability—schedule a confidential consultation today.

What is a Florida Income Deduction Order?

A Florida Income Deduction Order (IDO) is a court-issued order that requires an employer or payor to automatically withhold child support from a parent’s income and forward it to the Florida State Disbursement Unit. It ensures consistent, enforceable payments without relying on voluntary compliance.

How quickly does an income deduction order take effect in Florida?

Employers must start withholding support from the first pay period after receiving the order, typically within 2–4 weeks. The court or the Florida Department of Revenue sends the IDO directly to the employer, who must then remit payments promptly to the State Disbursement Unit.

Can I contest an income deduction order in Florida?

Yes. Parents have 15 days from notice of delinquency to request a hearing and contest an IDO, but only on limited grounds, such as a mistake of fact about the amount owed or the identity of the obligor. Missing the deadline means the IDO remains in effect.

What income sources can be withheld under a Florida income deduction order?

Income deduction orders apply to wages, salaries, bonuses, commissions, retirement income, and other periodic earnings. For self-employed parents, courts may order bank garnishment or property liens instead. Florida law requires most income sources to be subject to withholding for child support enforcement.

Can income deduction orders cover child support arrears?

Yes. Florida law allows employers to withhold additional funds—often up to 20% in addition to current support—until past-due arrears are paid. This accelerates repayment while ensuring current child support obligations continue to be met without disruption.

What happens if an employer ignores an income deduction order?

Employers that fail to honor a valid IDO can be held liable for the amount they should have withheld. Florida law allows courts to order penalties or judgments against non-compliant employers, making timely and accurate withholding a legal obligation with financial consequences.

Do income deduction orders end automatically when my child turns 18?

Not always. While most support obligations end at 18, orders may extend until age 19 if the child is still in high school and expected to graduate. Employers must continue withholding until they receive official termination or modification orders from the court.

Proudly Serving All Areas Of: