- Call for a

Confidential Consultation - 954-587-2244

- Email Us

-

Date Posted: August 17, 2025 2:43 am Author: Scott A. Levine

Divorce is already stressful, and the thought of your spouse hiding money or property just adds another layer of worry. Many people in Florida worry that their partner might hide assets to avoid splitting them.

Yes, spouses sometimes attempt to conceal money during a Florida divorce, but it’s illegal, and the courts can impose severe penalties if they are caught.

Hiding money during a divorce in Florida is illegal and can result in serious legal consequences. If your spouse conceals assets or income, you can take legal steps—like subpoenas and forensic audits—to uncover the truth and protect your fair share in the settlement.

Florida law requires both spouses to provide full financial disclosure during the divorce process. Even with that rule, some individuals still attempt to conceal bank accounts, investments, or property.

They might believe hiding assets will let them keep more, but that plan usually backfires. If you’re concerned, it’s helpful to recognize the warning signs and take steps to protect yourself.

Spotting unusual behavior and collaborating with professionals who can uncover hidden wealth can make a significant difference. There are ways to ensure you receive your fair share.

Hiding money during a Florida divorce breaks the law. State rules require you to disclose all your finances, and the court can hit you with big penalties if you don’t.

Courts can seize hidden assets and distribute them to the other spouse. They don’t mess around with this stuff.

Florida Family Law Rule of Procedure 12.285 states that both spouses must disclose all financial details during divorce. Each person has to file a Financial Affidavit within 45 days after being served.

The affidavit covers:

When you sign the affidavit, you’re swearing it’s true. Lying or leaving things out counts as perjury in Florida.

Both spouses must give a full financial picture during divorce. If you don’t, the court can impose sanctions immediately.

Either side can also request additional documents to verify the numbers. If things look fishy, the court can force you to hand over bank records, tax returns, and business documents.

Florida courts are not lenient with individuals who attempt to conceal assets during divorce proceedings. The judge might just give the hidden assets to the other spouse as a penalty.

Financial Penalties:

Judges often give the honest spouse a larger share of the remaining assets. If you try to cheat, it can cost you more than just your reputation.

Trying to hide money ruins the fairness of the process and makes the judge less likely to trust you on anything else.

Sometimes, criminal charges come into play. If you lie on sworn documents, you could end up facing perjury charges that follow you long after the divorce.

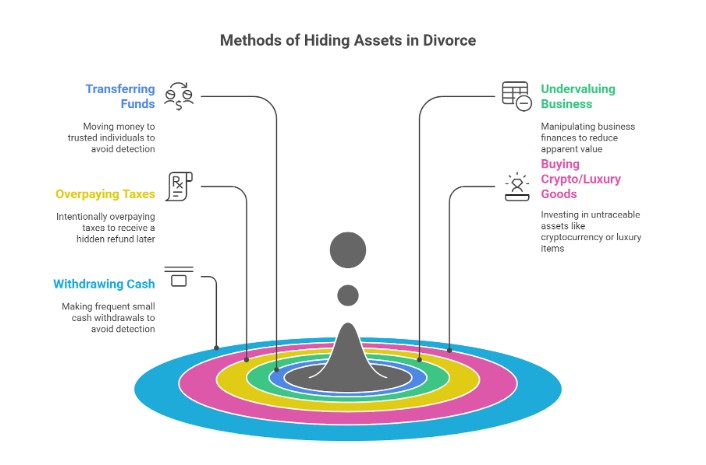

Spouses have devised numerous methods to conceal assets during divorce. Some move money to friends or family, others buy things that are hard to trace.

One popular option is to transfer money to a trusted family member or friend. The spouse asks them to hang onto cash or valuables until the divorce is over.

This way, the money disappears from the official records for a while. Later, they plan to retrieve it.

Fake loans are another trick. Someone claims they owe a relative and sends them payments, only to get the money returned after the divorce.

Some even overpay contractors or babysitters, using those extra payments to sneak money out of joint accounts. The service provider quietly returns the cash later.

Spouses sometimes open secret accounts or ask friends to hide things while the divorce is happening.

If your spouse runs a business, they’ve got extra ways to hide money. They might hold off on signing new deals or collecting payments until the divorce is done.

Some hold back bonuses or raises, working with partners or employers to delay that income. Others inflate expenses or fabricate debts to make the business appear less valuable.

They might even transfer business assets to another company they control, selling off assets at a low price to a shell company.

Overpaying taxes is a sneaky but simple trick. The spouse sends extra money to the IRS or boosts their paycheck withholdings.

That cash sits with the IRS until after the divorce, when they file for a refund. It won’t show up in regular bank records.

Some folks do the same with state taxes or property taxes. Any overpayment can be a hidden asset in disguise.

Cryptocurrency is tough to trace and easy to hide. Someone might buy digital coins with cash or move money through different accounts.

They can keep their crypto on hardware wallets or use privacy coins, which don’t appear on standard statements.

Luxury items, such as jewelry, art, or collectibles, work in a similar way. The spouse might claim they received them as gifts or understate what they actually paid.

Gold, silver, and precious metals are another favorite. People stash them in safety deposit boxes or private spots.

Even expensive hobby gear or sports equipment can hide value. The spouse might downplay what it’s worth.

Pulling out cash is a classic move. The spouse makes lots of small withdrawals, so banks don’t flag it.

They might start doing this months before the divorce, making it look like normal spending.

Some cash their paychecks instead of depositing them, then claim they earned less or had work expenses.

Money from side jobs or freelance gigs often stays off the books. The spouse just pockets the cash.

Renting a safety deposit box under their own name provides a secure location to store large amounts of cash.

Changes in financial behavior can be a giveaway. If your spouse suddenly becomes secretive or starts moving money around, something may be amiss.

Watch for signs like denying that assets exist or creating fake debts that are quickly paid off.

Look for these warning signs:

Missing paperwork is a classic red flag. If bank statements or tax returns are missing, or business records appear vague, that’s suspicious.

Sudden tech changes can also mean trouble. If your spouse starts using new devices or financial apps, they might be hiding a digital trail.

If you’re ready to get started, call us now!

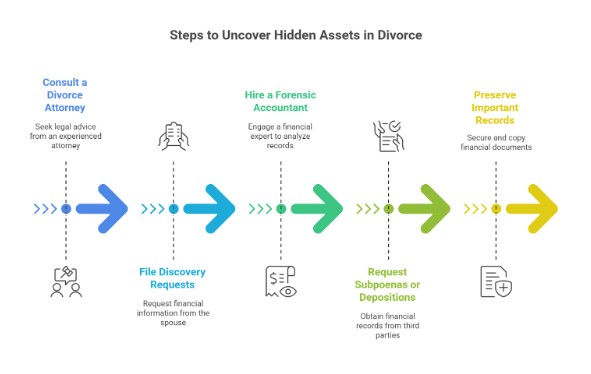

If you think your spouse is hiding money, you need to act fast to protect yourself. Your primary tools include legal assistance, discovery requests, financial experts, and maintaining the safety of all important documents.

Begin by consulting an experienced divorce attorney who is familiar with handling cases involving hidden assets. They’ll walk you through Florida’s discovery process and explain your rights.

Your lawyer can request discovery during the divorce to dig up hidden assets. They’ve seen all the tricks and have the right tools to uncover money, property, or investments your spouse tries to hide.

Why hire an attorney?

Don’t put this off. The sooner you get help, the better your odds of finding everything before it disappears.

Discovery means both spouses have to share financial information during divorce. Your attorney can file specific requests to force your spouse to cough up details.

Common discovery tools:

Florida law says both sides must fully disclose their finances. If your spouse lies or conceals information during discovery, they risk significant legal trouble.

Your spouse has to hand over bank statements, tax returns, investment accounts, and business records. They can’t just ignore these requests.

A forensic accountant digs into hidden assets and analyzes tricky financial records. They spot inconsistencies that could mean someone’s hiding money during a divorce.

These pros know how to follow money trails through multiple accounts and transactions. They’ll catch odd financial moves that most folks wouldn’t notice.

What forensic accountants look for:

Honestly, hiring a forensic accountant often pays for itself if you recover hidden assets. They tend to find more than enough to cover their fees.

Your attorney can request subpoenas to get financial records straight from banks, employers, or other third parties. This prevents your spouse from hiding or altering documents before you have a chance to review them.

Depositions let your attorney question your spouse under oath about their finances. Lying under oath? That’s perjury, and it carries real consequences.

Subpoenas can be obtained:

Banks and other third parties have to comply with valid subpoenas. Once the court gives the green light, your spouse can’t block these requests.

Start collecting and copying any financial documents you can get your hands on right away. If your spouse realizes you’re suspicious, they might try to destroy or hide records.

Important documents to preserve:

Make copies of everything and stash them somewhere safe—ideally somewhere your spouse can’t reach. Give your attorney a set for backup.

If you can’t copy something, snap a photo with your phone. Even partial records help forensic experts spot red flags for hidden assets.

Try not to tip your spouse off about your document gathering until your attorney says it’s okay.

If a court determines that someone has hidden assets, it can redistribute property, reopen cases, and impose sanctions. Florida courts don’t mess around with asset concealment—they’ve got plenty of ways to deal with it.

The court can award a larger share of marital property to the spouse who was more equitable. It’s both a punishment and a way to make things right.

Sometimes, the judge awards the innocent spouse additional assets equal to the value of the hidden assets. If the money’s gone, the court can just cut the guilty spouse’s share of what’s left.

Florida courts see hiding assets as serious misconduct during property division. This usually tips the scales in favor of the honest spouse at the time of settlement.

Common redistribution methods include:

Florida lets divorced spouses reopen final judgments if hidden assets come to light after divorce. Rule 1.540 is the legal door for that.

The innocent spouse must file a motion within a specified timeframe. They’ll need proof that assets were purposely hidden during the original case.

Courts want clear evidence of fraud or misrepresentation. Bank records, tax returns, and financial statements typically suffice.

Requirements for reopening include:

Judges can order the guilty spouse to pay the victim’s attorney fees and investigation costs. These sanctions punish bad behavior and try to make the innocent spouse whole again.

Courts might order immediate payment of the value of hidden assets. Interest and penalties can add up fast.

Some judges impose contempt of court penalties on offenders who break disclosure rules. That can mean fines or even jail time in serious cases.

Potential sanctions include:

Even years after a divorce, finding hidden assets can spark new legal action. Florida courts retain the power to modify property division if someone can prove fraud.

The innocent spouse can bring in forensic accountants and private investigators. These individuals sometimes discover offshore accounts, business interests, or even cryptocurrency stashes.

Courts can freeze assets that have just been discovered, preventing them from being lost while the case proceeds.

But act fast—there are time limits for post-divorce claims. The evidence must show that the assets actually existed during the marriage.

Levine Family Law handles complex equitable distribution cases across South Florida. If you’re noticing missing accounts or suspicious transfers, let’s discuss next steps. Reach out to us today.

If you’re ready to get started, call us now!

Forensic accountants utilize specialized tools and methods to identify and track hidden assets during divorce proceedings.

They’re good at spotting weird financial patterns and uncovering tricks that regular attorneys might overlook.

Forensic accountants dig deep to see if a spouse hid money or assets. They pour over every financial record they can get.

These experts create detailed spreadsheets that track incomes, expenses, and tax details. By the end, they’ll know exactly how much a spouse is worth.

Key tasks include:

The forensic accountant pulls together evidence for the court. Their reports reveal the location of hidden assets and their corresponding value.

Forensic accountants watch for telltale signs of asset hiding. Odd spending patterns often give away attempts to stash money.

Common red flags include:

Digital currency and electronic hiding methods are becoming increasingly prevalent. Skilled forensic experts can also trace cryptocurrency transactions.

Business owners sometimes fudge company finances to hide income. They might hold off on signing contracts or paying themselves bonuses until the divorce is finalized.

Hidden assets make fair property division impossible and cheat one spouse out of what they deserve. In high-asset divorces, professional investigation is a must.

Honestly, the cost of a forensic accountant can be a small investment compared to what they recover.

If there are businesses, multiple properties, or significant investments, these professionals can uncover thousands—or even millions—in hidden assets.

Cases that benefit most from forensic accounting:

Forensic accountants team up with divorce attorneys to build a strong case. Their analysis and testimony can sway court decisions on asset division and support.

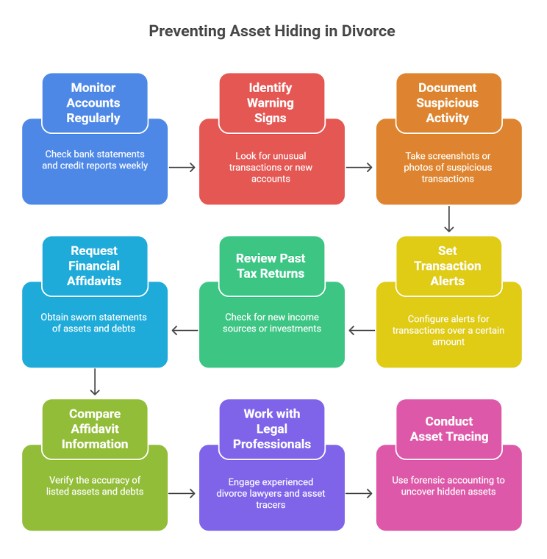

If you take action early in the divorce process, you’ve got a much better shot at stopping a spouse from hiding assets.

Keeping a close eye on accounts and working with experienced legal pros is your best bet against sneaky money moves.

Checking your accounts regularly is your first defense against hidden assets. Look over bank statements, credit card bills, and investment accounts at least weekly during divorce proceedings.

Key warning signs to watch for:

If you spot something unusual, document it immediately. Take screenshots or photos before the transactions vanish from online banking.

Many banks offer transaction alerts for transactions exceeding a specified amount. Set these to ping you for anything over $500 or $1,000—whatever fits your normal spending.

Go back and review tax returns from the last three years. Look for new income sources, investment accounts, or business interests you didn’t know about.

Check your credit reports monthly for new accounts or loans. Sometimes a spouse opens secret credit lines or borrows against hidden assets.

Financial affidavits force both spouses to list all assets, debts, income, and expenses under oath. Lying here carries serious penalties.

The affidavit must include:

| Asset Category | Required Information |

| Bank accounts | All checking, savings, and CDs |

| Investments | Stocks, bonds, retirement funds |

| Real estate | Primary home, rental properties |

| Business interests | Ownership stakes, partnerships |

| Personal property | Vehicles, jewelry, collections |

Ask for these documents early in the divorce process. The more time someone has, the easier it is for them to hide assets.

Compare what’s in the affidavit to what you already know. If accounts or assets are missing or undervalued, that’s a big red flag.

If things don’t add up, legal professionals can dig deeper through formal discovery.

Seasoned divorce attorneys know all the classic tricks for hiding money. They’ll spot red flags that most people miss.

Asset tracing specialists use forensic accounting to follow the money. They comb through bank records, business deals, and investment transfers to chase down hidden funds.

These pros have access to:

Generally, hiring asset tracing experts is a worthwhile investment. There’s often way more hidden money than the cost of the investigation.

Protecting your financial interests gets a lot easier with professional help, especially when there’s a lot at stake.

Get legal help early on to protect yourself from financial losses during divorce. A good attorney helps you spot hidden assets and act before your spouse gets sneaky with money.

If you suspect your spouse is hiding assets, time is crucial. The earlier you bring in an attorney, the better your odds of tracking down hidden money or property.

A seasoned divorce lawyer knows how to move fast. They’ll request financial records right away—bank statements, tax returns, business docs, you name it.

Your attorney can also ask the court to freeze assets. That way, your spouse can’t just move money to secret accounts or hand it off to family.

Warning signs to watch for:

If you wait too long, those hidden assets might vanish for good. Talk to your attorney to stop your spouse from hiding assets before or during divorce. Don’t put it off.

At Levine Family Law, we understand that facing financial dishonesty during divorce can feel overwhelming. That’s why we offer confidential consultations—so you can get clarity without pressure or commitment.

During your consultation, you’ll meet directly with attorney Scott A. Levine to review your concerns and learn your legal options under Florida divorce law.

Whether you suspect hidden accounts, business underreporting, or asset transfers, we’ll outline your rights and next steps to protect what’s yours.

What to bring with you:

We also offer extended financial strategy sessions for high-net-worth individuals or those with complex cases.

These sessions are designed to help you proactively uncover hidden assets, plan your financial roadmap, and build a strong legal case from day one.

Suspect financial dishonesty in your divorce? Levine Family Law helps uncover concealed income, accounts, or property during high-conflict cases. Schedule a confidential financial strategy session—contact us today.

Is it illegal to hide money during a divorce in Florida?

Yes, hiding money or assets during a divorce in Florida is illegal. Both spouses are legally required to fully disclose all financial information under Florida Family Law Rule 12.285, and failing to do so can result in court sanctions or a revised settlement.

What are the signs your spouse may be hiding money in a divorce?

Common signs include missing financial statements, unexplained cash withdrawals, sudden debts, locked digital files, or lifestyle changes that don’t match reported income.

How do Florida courts find hidden assets during divorce?

Florida courts can uncover hidden assets through subpoenas, the use of forensic accountants, mandatory financial affidavits, and depositions during the discovery phase of divorce proceedings.

What happens if my spouse is caught hiding assets in a Florida divorce?

If a spouse is found to have hidden assets, the court may redistribute the hidden funds, impose financial penalties, award attorney fees, or reopen the case under Florida Rule of Civil Procedure 1.540.

Can I reopen a divorce case if hidden assets are found later?

Yes, Florida law allows you to reopen a divorce case if you discover that your spouse concealed assets. You’ll need to file a motion and present evidence of fraud or misrepresentation.

What can I do if I suspect financial deception during divorce?

You should consult an experienced divorce attorney, preserve all financial records, and consider hiring a forensic accountant to investigate possible hidden assets.

What financial documents should I bring to a divorce consultation?

Bring recent tax returns, bank and credit card statements, pay stubs, property records, and any suspicious financial paperwork that may indicate concealed income or assets.

Proudly Serving All Areas Of: