- Call for a

Confidential Consultation - 954-587-2244

- Email Us

-

Originally published: October 2025 | Reviewed by Scott A. Levine

High-net-worth couples in Florida often face complex financial situations that make prenuptial agreements almost a necessity.

With substantial assets, business interests, and family wealth on the line, the stakes soar during a divorce.

Prenuptial agreements for high-net-worth individuals establish clear legal frameworks to address the division of wealth and other concerns in the event of divorce.

A comprehensive prenuptial agreement checklist helps wealthy couples protect everything from real estate portfolios to business ownership and intellectual property.

If you skip this step, Florida’s default property division laws may result in outcomes that don’t align with your intentions or reality.

To create a solid prenuptial agreement, you must pay close attention to Florida’s legal requirements and disclose all relevant financial information.

High-net-worth couples in Florida must ensure their agreements align with state law and address the complex financial arrangements that accompany substantial wealth.

High-net-worth prenups in Florida act as financial safety nets, especially when you’re juggling complex asset portfolios and business interests.

They offer security against Florida’s equitable distribution laws and help both partners get clear on their financial rights and obligations.

Many high-net-worth individuals enter marriage with substantial assets that require specialized protection and management.

Florida’s equitable distribution approach means courts divide marital property fairly, but not always equally, if you split up.

A prenup allows you to specify which assets will remain separate—such as family businesses, investments, real estate, and inheritance money.

If you skip this, those assets might end up on the chopping block.

Key assets to protect include:

Legacy preservation matters significantly if you have generational wealth. The right agreement can ensure that family assets are distributed to the intended heirs, rather than becoming entangled in a divorce mess.

High-income couples in Florida often face sky-high divorce costs when lots of assets are involved.

Valuing multiple properties, businesses, and investments can incur hundreds of thousands of dollars in legal fees.

Prenups set out clear rules for splitting assets before emotions take over. With that framework, you can skip most of the drawn-out court battles and pricey expert witnesses.

There’s more to it than just cutting legal costs. Prenups help you avoid:

| Cost Factor | Without Prenup | With Prenup |

| Legal fees | $50,000-$200,000+ | $10,000-$30,000 |

| Asset valuation | $15,000-$50,000 | Minimal |

| Court time | 12-24 months | 3-6 months |

Prenuptial agreements offer clarity and encourage couples to discuss finances openly before getting married.

These conversations reveal very different views on spending and managing money, which is beneficial to know ahead of time.

Both sides must lay out their full financial picture. That kind of transparency can build trust and prevent ugly surprises later.

When you know exactly what you’d get in different scenarios, it takes a lot of anxiety out of the equation.

Benefits include:

Prenups also make estate planning easier. They work alongside wills and trusts, so your wealth transfer plan stays consistent.

Planning marriage with significant wealth or business assets? Levine Family Law assists high-net-worth couples in Florida in drafting comprehensive prenuptial agreements. Protect your financial future—contact us today.

If you’re ready to get started, call us now!

High-net-worth couples have to cover financial issues that standard prenups just don’t touch. A Florida prenuptial agreement can address asset protection, business interests, and inheritance planning—each one needs careful documentation and smart planning.

| Category | Key Considerations | Details / Examples |

| Full Financial Disclosure | Mandatory in Florida; foundation of enforceability | Bank statements, investment portfolios, 3 years tax returns, business valuations, real estate deeds, retirement accounts; all income streams disclosed (including partnerships/offshore accounts) |

| Property Division | Define separate vs. marital property | Premarital real estate, investment accounts, heirlooms, IP rights, stock options; address appreciation of assets; document to prevent commingling |

| Inheritance & Trust Interests | Protect family wealth & succession rights | Future inheritances, existing trusts, family business succession, generation-skipping trusts, and charitable remainder trusts outline the handling of distributions during marriage |

| Business Ownership | Shield businesses from division in divorce | Pre-marital ownership percentages, treatment of equity growth, management rights, buy-sell agreements, key person insurance; address professional practices (law/medical offices) |

| Alimony & Spousal Support | Predefine support terms outside the court’s discretion | Monthly limits, duration caps, modification rules, termination triggers (remarriage/cohabitation), COLA adjustments, and sliding scales based on marriage length |

| Debt Allocation | Prevent liability disputes | Separate premarital business debts, investment loan responsibility, credit card/personal debt isolation, mortgage division, tax liability allocation; protect non-owner spouse from guarantees |

| Lifestyle Clauses | Address privacy, conduct & reputation | Social media/privacy restrictions, infidelity penalties, substance abuse consequences, residence requirements, children’s education/religion terms; courts favor enforceable financial/privacy terms |

| Sunset Provisions | Allow agreements to evolve over time | Triggers: 10–20 year marriage milestones, children’s birth, retirement, major wealth changes, health crises; terms may expand or expire with time |

Florida courts require both spouses to disclose all their financial information, including assets, debts, income, and so on.

This is the foundation for any prenup that stands up in court.

Required Financial Documents:

Wealthy individuals typically have complex income streams. You’ve got to spell out all those business entities, partnerships, and offshore accounts.

If you hide assets or don’t fully disclose, you might blow up the whole agreement. Florida courts will scrutinize high-value prenuptial agreements to ensure that all parties understand the terms of the agreement.

Prenuptial agreements allow couples to determine what constitutes marital property and what remains separate.

This is a big deal if you’re walking in with serious premarital assets.

Separate Property Classifications:

You need to determine how you’ll treat the appreciation of separate assets during marriage. Some people keep all the growth separate; others let some of it become marital property.

Commingling is the biggest danger. If you mix separate funds with marital money, you could accidentally turn it all into marital property unless you document everything carefully.

High-net-worth families often establish complex trusts and have substantial expectations for their inheritances. You need to clearly carve these out in the prenup.

Key Inheritance Protections:

Trust distributions you get during marriage usually stay separate if you document them right. However, if you put those funds into a joint account, you need to outline clearly what happens in the event of a dispute.

Some families even require prenups to protect family wealth from divorce. That way, future generations who benefit from the family trust don’t lose out.

Business interests are by far the most complex assets for high-net-worth prenuptial agreements. Prenuptial agreements can protect certain future earnings and business growth from being considered marital property.

Business Protection Elements:

You need to decide whether a non-owner spouse is entitled to any share of business growth during the marriage.

Most entrepreneurs want to keep all business appreciation separate so they don’t have to sell or split the company in the event of a divorce.

Professional practices, such as law or medical offices, require even more careful planning. These businesses are difficult to value or split, so a prenuptial agreement is essential.

Florida prenuptial agreements can establish alimony arrangements that differ significantly from what a court might order.

High earners usually want predictable support terms, not whatever a judge thinks is fair that day.

Alimony Considerations:

Some couples build in sliding scales so that longer marriages are accompanied by more support. It’s a way to encourage commitment but still protect against runaway awards.

Don’t forget to cover what happens if the paying spouse’s income drops. Business owners, in particular, need to plan for downturns that could impact their ability to pay.

High-net-worth couples often have substantial debts, including business loans, investment leverage, and real estate mortgages. You’ve got to spell out who’s responsible for what.

Debt Protection Strategies:

Business debts are especially tricky since banks often want personal guarantees. The spouse who doesn’t own the business needs protection from getting dragged into those liabilities.

Some couples agree that debts tied to separate property remain with the person who incurred them. That way, one partner doesn’t end up paying for the other’s obligations.

Lifestyle provisions set out behavioral expectations and consequences for high-profile couples. These clauses must comply with Florida law and protect the couple’s genuine interests.

Enforceable Lifestyle Terms:

Courts in Florida typically enforce lifestyle clauses that have clear financial implications, rather than just moral judgments. Judges tend to give more weight to privacy protections than to morality-based penalties.

Many high-profile individuals seek confidentiality agreements to prevent the disclosure of personal or business information. These terms help protect their reputation and business interests.

Sunset clauses automatically change or end prenuptial agreements after certain time periods or big life events.

These provisions acknowledge that long marriages often involve changing circumstances.

Common Sunset Triggers:

Some couples prefer agreements that become more generous over time, reflecting their increasing contributions to the marriage. Others stick with the same terms from start to finish.

Sunset provisions should clearly outline what changes are made and whether a new agreement is required. Precise wording helps avoid fights later about what the changes really mean.

Florida follows the Uniform Premarital Agreement Act, as outlined in Florida Statute 61.079. This law establishes stringent requirements for valid prenuptial agreements, ensuring that both parties sign willingly and voluntarily.

Florida law outlines the requirements for a prenuptial agreement to be considered legally binding. The agreement must be in writing and signed by both parties before their marriage.

Written Documentation Requirements:

The agreement takes effect automatically upon the commencement of the marriage. Couples can’t create a binding prenuptial agreement after the wedding has started, even if they want to.

Florida’s prenuptial agreement laws provide couples with considerable flexibility in what they include. Still, the state keeps a close eye on what’s actually enforceable.

Permitted Provisions Include:

The voluntary agreement should focus on financial matters. Personal conduct or child-related terms tend to run into legal trouble.

Florida courts employ a two-part test to determine whether a prenuptial agreement is enforceable. The agreement has to be both fair in process and fair in substance when signed.

Procedural Fairness Requirements:

The lack of independent counsel significantly increases the likelihood of challenging a prenuptial agreement. Judges closely examine whether both parties truly understood what they were signing.

Substantive Fairness Standards:

Both parties have to make a genuine choice. If someone rushes the process or uses undue pressure, courts often invalidate the agreement.

Courts also look at how financially savvy each person is. Wealthy couples, in particular, need to demonstrate that they each received sound legal advice and had sufficient time to review it thoroughly.

Florida law provides several avenues for challenging a prenuptial agreement in court. Most challenges focus on problems with the process or unfair conditions that existed at the time the agreement was signed.

Common Challenge Grounds:

Timing often comes up in these challenges. If someone drops the agreement just days before the wedding, that can appear to be duress, especially with significant wedding expenses looming.

Procedural Defects Include:

The person challenging the prenup must prove that there was a valid reason for the prenup to be set aside. They require clear evidence of unfairness or a breach of rules in the process.

Estate planning issues can become significant challenges. If a prenuptial agreement alters inheritance rights, courts scrutinize the fairness and voluntariness of the agreement even more closely.

Florida courts examine whether both parties had good legal help. Having independent counsel makes it significantly more challenging to successfully challenge a prenuptial agreement.

From inheritance planning to business ownership, every detail matters in a Florida prenup. Levine Family Law ensures that your agreement covers everything. Schedule a confidential consultation now.

If you’re ready to get started, call us now!

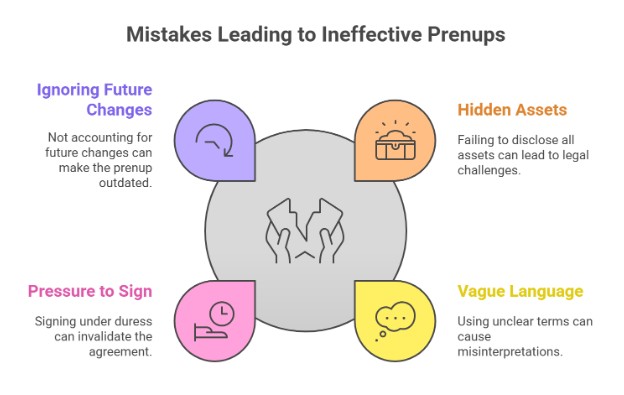

High-net-worth individuals encounter unique challenges when drafting prenuptial agreements.

Critical mistakes often involve hiding assets, using unclear language, rushing the process, or failing to account for future changes in wealth.

Full financial transparency is the backbone of any enforceable prenup. Courts expect both parties to disclose all assets, debts, income sources, and financial ties before signing.

If someone hides assets, it can blow up the entire agreement. Judges will toss prenups if they find secret property or income, putting everything at risk in a divorce.

Common hidden assets include:

High-net-worth folks often have complicated finances. They need to list all business partnerships, investment vehicles, and family trusts. Sometimes, only a professional appraisal can pin down the value of art or private company shares.

High-net-worth couples should team up with financial advisors to build a full asset inventory. This protects both spouses and makes the prenup much harder to challenge.

Specific language keeps everyone on the same page and avoids future fights. Vague terms like “reasonable support” or “fair division” just invite trouble down the line.

Judges can’t enforce what they can’t pin down. They require clear instructions for dividing assets, establishing spousal support, and categorizing property. Fuzzy language only leads to more legal bills.

Examples of problematic language:

Definitions matter—a lot. The prenup should clearly outline what constitutes separate property, what constitutes marital property, and how any appreciation in these assets is handled. For spousal support, set clear income triggers for changes.

Lawyers who know high-net-worth cases use language that holds up in court. They avoid the wishy-washy stuff that causes headaches later.

Timing makes or breaks a prenuptial agreement. Courts consider whether both parties had sufficient time to review the terms and consult with their own lawyers.

Rushed prenups face legal challenges. If someone signs just days before the wedding, judges may consider that as duress and invalidate the agreement.

Recommended timeline:

Each person needs their own lawyer. This becomes even more important when a significant amount of money is involved, as conflicts of interest can arise quickly.

Mediation can sometimes help when negotiations become tense. A professional mediator can guide tough talks about money or business, making the process less stressful.

Sticking with a static agreement can backfire as life changes. High-net-worth individuals often experience significant fluctuations in their wealth over time.

Prenuptial agreements should include clauses for major life changes. Business sales, inheritances, or career shifts can totally change the financial picture. Fixed terms might become unfair or unworkable in the future.

Common triggering events:

Estate planning coordination is key. Prenuptial agreements should align with wills and trusts; otherwise, things can become messy quickly.

Regular reviews keep prenups up to date. Many couples establish a schedule to revisit the agreement every five or ten years, allowing it to reflect changes in tax laws or evolving family needs.

Financial advisors can flag when a prenuptial agreement no longer serves its purpose. With regular check-ins, couples can update terms before they become a problem.

Legal guidance proves essential for high-net-worth couples drafting prenuptial agreements to protect complicated assets and business interests.

Independent legal counsel ensures that both parties receive fair representation and helps address unique financial situations and potential future changes.

High-net-worth couples face financial situations that are anything but straightforward. They require customized legal solutions because standard prenuptial templates are insufficient.

Those templates can’t handle the complex aspects—such as business structures, investment portfolios, or family trusts. It’s a different ballgame entirely.

Prenup attorneys specialize in protecting specific assets. They know how to craft clauses that keep businesses running smoothly even if divorce is on the table.

Key areas that need customization:

Legal counsel reviews each spouse’s finances separately. This way, the agreement actually covers what matters to both people.

Attorneys also keep Florida’s laws regarding marital property in mind. They design agreements to fit state rules and still protect assets as much as possible.

Independent legal counsel represents each spouse during negotiations of the prenuptial agreement. If one person lacks proper representation, Florida courts may dismiss the agreement.

Each spouse needs their own attorney, especially when there’s a significant wealth disparity. It helps avoid messy conflicts of interest.

Attorneys help keep negotiations fair by:

Legal guidance helps both spouses understand their rights under Florida law. Attorneys guide them through how the agreement alters the standard rules for marital property.

Experienced counsel helps prevent things from becoming too one-sided. They know how to strike a balance between protecting assets and staying fair.

Negotiations often reveal areas where compromise benefits everyone. Good attorneys guide couples toward solutions they can both live with.

Prenuptial agreements aren’t set in stone. As finances shift, couples need to update their agreements, and obtaining legal guidance is crucial in this process.

Significant life changes—such as a booming business, an inheritance, or a major career move—can render the original prenuptial agreement less effective.

Some common reasons to update a prenup:

Professional legal support keeps modifications enforceable. Attorneys draft amendments that fit current Florida laws.

Legal counsel reviews the whole agreement during updates. They identify outdated terms that are no longer effective.

Proper documentation is key when things change. Attorneys ensure that all modifications receive the correct signatures and notarization.

As a business grows, couples may need to revise their prenuptial agreement to accommodate new partnerships or ownership changes. Legal guidance helps them cover these new situations.

A well-crafted prenuptial agreement gives high-net-worth couples in Florida a solid foundation. These legal documents lay out clear guidelines for asset protection and financial security.

High-income couples often benefit significantly from establishing prenuptial agreements before marriage. These agreements safeguard family wealth, enabling both spouses to maintain financial security.

The lower-net-worth partner should always hire their own prenuptial agreement lawyer to review the agreement before signing. That way, they get fair representation and their interests stay protected.

Timing matters when creating these agreements. Couples really should start the process months before their wedding to avoid last-minute stress or pressure.

Professional guidance makes a massive difference throughout. Experienced attorneys are familiar with Florida’s requirements and can draft enforceable agreements that withstand legal challenges.

A strong prenuptial agreement is your safeguard against uncertainty. Levine Family Law guides Florida couples through every step of the process. Take control of your future—contact us today.

Why do high-net-worth couples need a prenuptial agreement in Florida?

High-net-worth couples face complex financial issues involving businesses, inheritances, and international assets. A prenuptial agreement (prenup) protects wealth, clarifies property division, and reduces uncertainty in the event of divorce.

What financial disclosures are required in a Florida prenup?

Both spouses must fully disclose all assets, debts, income, and financial obligations. This includes bank accounts, business valuations, tax returns, real estate, and investment portfolios. Failure to disclose can make the prenup unenforceable.

Can a Florida prenup protect business interests?

Yes. A prenup can specify that premarital businesses, future equity growth, and management rights remain separate property, protecting entrepreneurs and professionals from losing control of their business in a divorce.

Do prenuptial agreements in Florida cover inheritances and trusts?

Yes. Prenuptial agreements can safeguard existing and future inheritances, trust interests, and family business succession rights, ensuring family wealth remains protected from divorce settlements.

Can couples decide alimony terms in a Florida prenup?

Yes. Florida law allows prenuptial agreements to define spousal support limits, duration, and terms for modification. This provides predictability for high earners while ensuring fairness for both spouses.

How do Florida prenuptial agreements (prenups) handle debt allocation?

A prenup can assign responsibility for premarital debts, business loans, mortgages, and tax liabilities. This protects one spouse from being forced to cover the other’s financial obligations.

Are lifestyle clauses enforceable in Florida prenups?

Courts may enforce lifestyle clauses if they relate to financial or privacy matters, such as social media restrictions or confidentiality. Moral-based clauses, like penalties for infidelity, are less likely to be upheld.

What are sunset provisions in a Florida prenup?

Sunset provisions allow prenuptial agreements to expire or be modified after milestones such as 10–20 years of marriage, the birth of children, or retirement. They ensure agreements adapt to life’s evolving circumstances.

Proudly Serving All Areas Of: