- Call for a

Confidential Consultation - 954-587-2244

- Email Us

-

Originally published: July 2025 | Reviewed by Scott A. Levine

Dividing retirement accounts can be one of the most stressful parts of a Fort Lauderdale divorce.

Couples often ask what happens to retirement savings, such as 401(k)s and pensions, during a divorce, and Florida law has clear rules on how these accounts are divided.

Most retirement savings earned during the marriage are divided fairly between both spouses, even if only one person’s name is on the account.

Many people are surprised to learn that assets such as stocks, pensions, and benefits earned at work can be considered marital property.

The rules can be complicated, but there are ways to protect your future and avoid costly mistakes.

Attorney Scott A. Levin shares valuable tips and important information to help couples in Fort Lauderdale understand how to approach dividing their retirement savings.

Knowing your rights can make a big difference when planning for life after divorce.

This guide is designed to provide you with the essential information you need to know about dividing accounts and planning for a stable financial future.

Retirement accounts are often some of the most valuable assets a couple owns.

Florida law establishes clear guidelines for dividing these accounts in divorce.

Florida uses an equitable distribution approach, which means that assets are not always split 50/50; rather, they are divided in a manner the court deems fair.

Marital assets include retirement account funds earned or contributed during the marriage, even if the account is only in one person’s name.

Non-marital assets are funds that were earned or deposited into a retirement account before the marriage or after the date of separation.

If a spouse can prove that a part of their retirement account came from before the marriage, that part may be excluded from division.

However, any growth or interest earned on those funds while the couple is married could be included for distribution.

This rule applies to both pensions and private retirement plans.

Some of the most common retirement accounts that must be divided include:

Each account type has different rules.

For example, the IRA versus 401(k) division in a Florida divorce is not exactly the same.

401(k)s and pensions often require a special court order, known as a QDRO (Qualified Domestic Relations Order), to facilitate the division of funds. In contrast, IRAs typically do not need a QDRO but still necessitate careful paperwork.

Mistakes in dividing these accounts can lead to taxes or penalties. Knowing which accounts are involved helps both spouses prepare.

Feeling overwhelmed by the idea of losing part of your retirement in divorce? Scott A. Levin helps Fort Lauderdale spouses understand what’s truly fair in retirement account division. Let’s talk—contact us today.

If you’re ready to get started, call us now!

Dividing retirement accounts in a Florida divorce involves determining what constitutes a marital asset, calculating its value, and then following the correct legal procedures to split the funds fairly.

Each type of retirement account, including 401(k)s, pensions, and IRAs, is treated differently under Florida law and follows distinct rules.

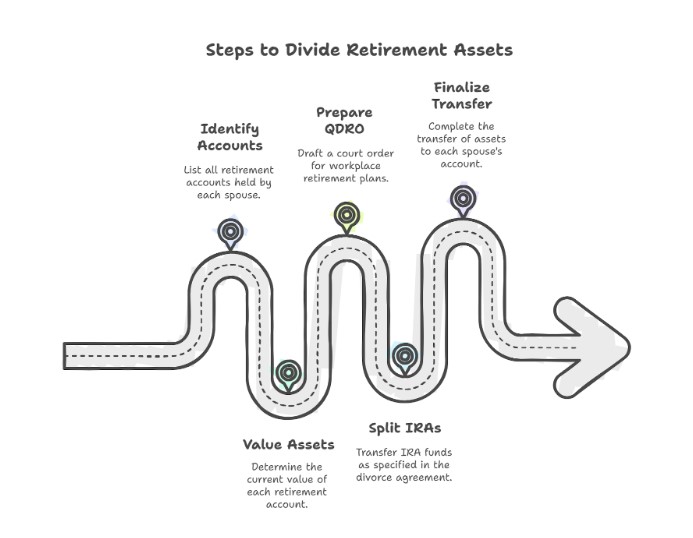

The first step for couples in Fort Lauderdale is to list all retirement accounts each spouse holds.

Common accounts include 401(k)s, pensions, IRAs (both regular and Roth), and sometimes government retirement plans.

What matters is whether the money saved was earned during the marriage—this is usually considered marital property.

Account statements and plan documents help with valuing accounts.

The current balance, plus any employer contributions made during the marriage, is reviewed.

For pensions, a professional may need to calculate the present value since benefits are paid in the future.

With a clear record, both parties can use a retirement account divorce checklist to stay organized. The spouses should collect statements and evidence from the date of marriage to the date of separation.

This makes the process smoother and helps ensure that both parties receive their fair share, as required under Florida’s equitable distribution rules.

A QDRO is a special court order required to divide most workplace retirement plans, such as a 401(k), in the context of a divorce or pension division in Florida.

The QDRO instructs the plan’s administrator on how to divide the account between spouses without incurring penalties or taxes at the time of the transfer.

The attorney prepares the QDRO after the divorce is finalized. It has to be approved by both the judge and the retirement plan.

Some plans have their own QDRO forms or special requirements, so following instructions is key.

The QDRO also makes sure that each party’s share is protected, and each spouse pays tax only on their portion when money is withdrawn in the future.

Couples should double-check with their plan’s administrator to avoid mistakes, as errors can delay the transfer or result in the loss of benefits.

IRAs (Individual Retirement Accounts) and Roth IRAs are split differently from workplace plans.

In Florida divorces, a QDRO is not required to divide IRAs.

Instead, the court order or divorce agreement specifies how much is allocated to each spouse, and then the transfer is made as a rollover to avoid taxes.

To split an IRA, the IRA owner should contact the financial institution and follow their specific process, which typically involves completing forms and providing a copy of the divorce decree.

The funds move directly from one spouse’s IRA to the other’s new or existing IRA account.

This way, taxes and penalties can be avoided if done correctly.

Keeping accurate records and tidying up paperwork is essential for splitting IRA or Roth IRA accounts.

Anyone handling a split IRA in a Florida divorce or other retirement assets should keep a checklist to avoid skipped steps or tax mistakes.

Dividing retirement accounts during a divorce can result in tax penalties if not handled correctly.

Careful planning ensures both parties keep more of their money, avoid IRS trouble, and reduce stress during an already difficult time.

Withdrawing funds early from a 401(k) or IRA, before age 59½, often triggers a 10% penalty plus standard income taxes.

However, couples in Florida can use a legal order called a Qualified Domestic Relations Order (QDRO) to split a 401(k) or similar plan without paying that penalty.

It is important to request the QDRO before transferring any money.

Without it, the IRS will view the transaction as an early withdrawal, penalizing the person who withdraws the funds.

The QDRO allows the spouse who receives the money to transfer it into their own IRA without incurring penalties.

IRAs do not require a QDRO, but the transfer must be done directly (trustee-to-trustee) as part of the divorce settlement.

Failing to follow these steps can result in substantial tax penalties.

Traditional IRAs offer tax deductions when you put money in, but require you to pay taxes when you withdraw in retirement.

Roth IRAs use after-tax dollars, but qualified withdrawals later are tax-free.

When splitting IRAs in a divorce, it’s vital to know which type you are working with.

Moving a Roth IRA to a former spouse allows them to keep the tax-free growth and withdrawals if done correctly.

If a traditional IRA is being split, the receiving spouse should be aware that they’ll owe taxes later when they withdraw the money.

Naming the correct IRA type in the divorce paperwork matters. Mistakes can lead to confusion about who is responsible for taxes in the future.

Couples splitting different accounts may need help from a tax professional to avoid errors and maximize savings.

The exact language in divorce agreements matters for retirement splits.

A carefully written QDRO or settlement order will clearly instruct the plan administrator on how to divide the funds and specify who is responsible for future taxes.

Clear instructions can specify whether the receiving spouse receives a lump sum, a percentage of the total, or a fixed dollar amount.

The order should also explain whether gains or losses after the separation date affect the split.

Incorrect or missing wording can result in delays, additional taxes, or penalties. Legal professionals typically assist in drafting and reviewing these documents.

For couples in Fort Lauderdale, expert help ensures that retirement assets are divided without mistakes that could lead to financial losses or IRS issues.

One wrong move in dividing your 401(k) or pension could cost you years of savings. Scott A. Levin handles divorce litigation with a focus on protecting your financial future. Schedule a private consultation today.

If you’re ready to get started, call us now!

Failing to split retirement accounts correctly can result in both financial loss and legal issues.

In Florida, if couples don’t follow clear rules, one spouse may lose out on benefits they deserve.

Dividing retirement in divorce in Florida is not automatic.

The court order must be detailed, and for plans like 401(k)s, a special document called a QDRO is usually required.

Possible risks include:

| Mistake | Possible Result |

| No QDRO filed for 401(k) | Loss of rights to retirement funds |

| Incorrect account values used | Unequal or unfair division |

| Early withdrawal without court approval | 10% tax penalty and extra tax owed |

If a couple does not divide properly, the plan administrator may deny the transfer.

This can delay the divorce process and increase legal costs. It’s also possible that the wrong account value gets used during the divorce.

When this happens, one spouse may end up with much less, or much more, than is fair.

Mistakes can also mean paying the IRS extra taxes. If funds are withdrawn or transferred incorrectly, individuals may face a penalty of 10% or more before reaching age 59½.

To avoid major problems, it’s important to have guidance from a qualified attorney, such as Scott A. Levin.

He understands the process of what happens to retirement accounts in divorce in Florida and can help ensure they are divided according to the correct rules.

Different life stages and job backgrounds can change how retirement accounts are split.

Older couples and families with government or military jobs often face rules that are not always clearly defined.

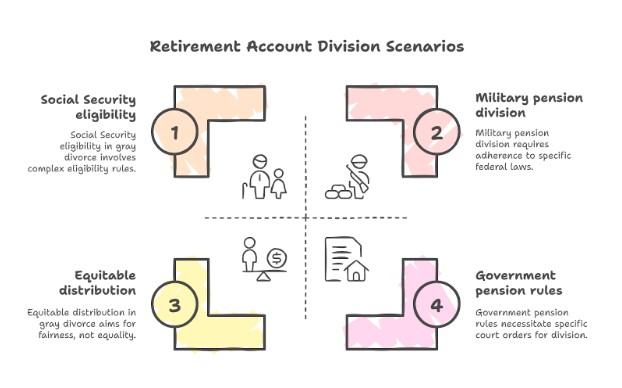

For couples divorcing after the age of 50, known as “gray divorce,” retirement accounts are often the most significant assets they own.

The division of retirement funds can affect both immediate finances and long-term security.

Because Social Security and pensions may be tied to years of marriage, splitting assets must take into account each person’s future needs.

Key points in gray divorce:

Gray divorce may also mean working longer or changing retirement plans.

Couples should seek guidance from professionals who are familiar with Florida’s retirement account rules.

Divorces involving government or military pensions have extra steps.

Government retirement plans, including federal and state pensions, are subject to special legal requirements in Florida.

Key differences for these cases:

Couples should work with attorneys who understand these unique rules. Extra paperwork and strict timelines can affect how and when benefits are paid.

Trying to handle a divorce without a lawyer might seem like a way to save money, but it can lead to expensive mistakes.

Even minor errors in paperwork or legal steps can cause significant issues with your finances and retirement accounts.

Divorce laws are complex, particularly when it comes to retirement accounts, such as 401(k)s and pensions.

An experienced attorney for QDROs in Fort Lauderdale can ensure that forms are filled out correctly and deadlines are met.

Common risks of DIY divorce:

Online information is not always reliable.

Using internet tips for your divorce can be risky because legal advice should be tailored to your unique situation.

Mistakes in dividing assets, especially retirement funds, can be difficult and costly to rectify later.

Some errors may even cause you to receive less money than you deserve or create unexpected tax issues. An attorney can also handle tough conversations and paperwork.

This can help reduce stress, keep the divorce process on track, and protect your interests throughout the entire process.

Fort Lauderdale residents trust Scott A. Levin for complex divorce cases due to his expertise in family and matrimonial law.

He assists with complex issues, such as dividing retirement assets and financial planning during divorce.

Many couples face challenges when it comes to splitting retirement accounts, especially in high-net-worth cases.

Scott A. Levin is recognized as a leading lawyer in the retirement asset division in South Florida.

He makes sure assets like pensions and 401(k)s are handled correctly.

Clients value that Scott A. Levin handles cases involving property, business, and other financial matters.

He guides couples through the details of Florida’s divorce law, making the process easier to understand.

Key reasons people choose Scott A. Levin:

| Service | Benefit for Clients |

| Retirement account division | Safeguards your long-term interests |

| Divorce financial planning | Helps plan for stability post-divorce |

| Complex case experience | Manages challenging legal situations |

Scott A. Levin’s firm in Fort Lauderdale is recognized for its attention to detail and supportive guidance through every step of the divorce process.

Couples seeking the best divorce lawyer for retirement accounts in Florida often turn to his office for assistance.

You’ve worked hard for your retirement—don’t let divorce undo that. Scott A. Levin guides Fort Lauderdale clients through complex asset division with clarity and calm. Reach out now to get started.

How are retirement accounts divided in a Florida divorce?

In Florida, retirement accounts are divided through equitable distribution, meaning they’re split fairly, but not always equally. Only the portion accrued during the marriage is considered marital property, which is subject to division by the court or through a settlement agreement.

Do you need a QDRO to split a 401(k) in a Florida divorce?

Yes, a QDRO (Qualified Domestic Relations Order) is required to legally divide a 401(k) or pension plan in a divorce proceeding in Florida. It authorizes the plan administrator to transfer funds without triggering tax or penalty consequences. It must be drafted separately and approved by the court and the plan provider.

Can IRAs be divided without a QDRO in Florida?

Yes, IRAs do not require a QDRO in the state of Florida. Instead, a divorce decree or marital settlement agreement can authorize a transfer via a “trustee-to-trustee” rollover. This method avoids early withdrawal penalties if done correctly.

What happens if only one spouse contributed to the retirement account?

If the retirement account grew during the marriage, the portion earned during that time is still considered marital property, even if only one spouse contributed. Florida law focuses on when the contributions were made, not whose name is on the account.

Are retirement accounts split 50/50 in Fort Lauderdale divorces?

Not always. Florida uses equitable distribution, not automatic 50/50 splits. Courts consider factors such as each spouse’s financial situation, the length of the marriage, and contributions to the household when dividing retirement assets.

What’s the tax impact of dividing retirement assets in divorce?

If divided correctly, there are no immediate taxes or penalties when splitting retirement accounts in a divorce. A properly executed QDRO or IRA rollover preserves tax-deferred status. However, future withdrawals are still subject to tax, depending on the type of account.

Proudly Serving All Areas Of: